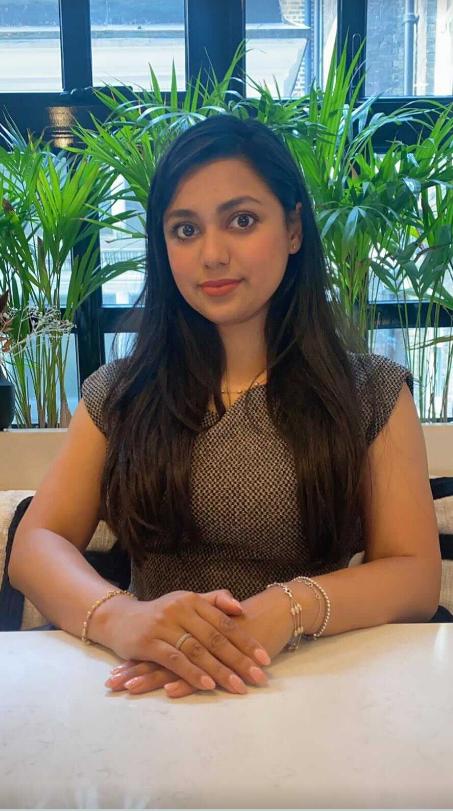

Helena Kazi – Creating a insurtech startup that will revolutinize the gig economy

July 11, 2022

Helena Kazi is the CEO and founder of GIGANOMICS – a new insurtech startup that is on a mission to revolutionize the gig economy. GIGANOMICS is a data-driven hyper-personalised insurance provider for the gig economy, coupled with banking and lending facilities. Helena took some time out of her busy schedule to share with all of us the story behind GIGANOMICS.

What is the story behind your company?

I have always had an interest in the pensions and insurance space. The lack of disruption in the insurance and pensions space lead to launching GIGANOMICS and my passion for this unloved Industry. I have worked within the Fintech industry and ecosystem for a number of years and really absorbed all of its movements firsthand.

I know insurance and pension are on the verge of disruption and it’s going to be HUGE. GIGANOMICS was born, hyperpersonalised insurance for the gig economy, using big data and Ai we are going to refine vehicle pricing models in insurance by providing fairer and accurate vehicle insurance. We are also providing health, life and business liability insurance to our entire customer base.

We have also teamed up with Klarna to offer financial products to an otherwise underserved market. It’s a partnership we are most excited for.

How is your company different from your competition? What is your USP?

How does your company innovate?

Our innovation is primarily through partnering with some of the worlds best gig platforms as well as smaller outfits, we are utilising the data from our partners to better underwrite and risk profile our customers. This will provide more competitive prices for our insurance products with a key focus on the trillion dollar motor insurance market.

What is the most difficult aspect of running your own company?

There are so many moving aspects of the business, currently I am doing everything from sales and marketing to business operations to managing investment and keeping a close eye on hiring prospectives and so forth.

I am really looking forward to building my initial team who I can efficiently delegate to and focus on more core aspects of the company as CEO. Managing different parts of my company, the entire team and not taking my eyes off of our company objectives and vision is primary to me.

Your company is given $1M, how would you spend/invest them?

A lot of the groundwork for GIGANOMICS is now in place, and I’ve just kicked off fundraise. We are seeking investors from USA & U.K./EU as these are the primary target markets we are going to launch in, with customers we are already engaged with.

$1M of investment will mostly be spent on key hires, I’m seeking top engineers, data scientists, underwriters, and designers. The core team will work on product building and delivering to our client base and end users and customers who have already shown keen interest in working with us.

I am also excited to work on our company branding and design but hiring and product development is core for our initial funding phase. Now is the time to build out the core team and execute efficiently.

Where is your company headed now?

We have laid out our main groundwork, and have some interesting partnerships in place. These relationships are core for us at GIGANOMICS to bring our vision to life and to be a global player in the world of insurance and financial banking.

We are really striving for our core customer base to get to know us and help us in building our products they would love and use. Everything I’m doing is for the end customer, we are a super customer-centric company where our customers’ needs and wants come first.

What collaboration do have right now? How do these collaborations impact the growth of your company?

We are working with Klarna on our open banking initiative which I’m excited for, this will enable us to provide our entire customer base with credit and lending facilities. The gig economy doesn’t have credit lending offered to them as easily as employed individuals due to the fluctuations of earned income and we want to change that. We are the one shop stop for gig workers from insurance and protection to financial lending and banking.

Any company which fails to partner doesn’t understand the compounded growth and impact this has on the overall business growth. I am even looking to collaborate with some of our competitors. GIGANOMICS is intrinsically a collaborative company from day one.

More must-read stories from Enterprise League:

- The golden rules you need to build a steady buyer-seller relationship.

- The advantages and disadvantages of using social media for business.

- Leadership traits that are a must for any business owner.

- The best networking events online entrepreneurs shouldn’t miss.

Related Articles

Leslie Polizzotto – From practicing law to running a doughnut shop

How do you go from practising law to running a world-famous doughnut shop in NYC? Leslie Polizzotto has the recipe for success.

Aja Blanco – There is no business success without customer success

Aja Blanco discovered early on her entrepreneurial journey that business success depends entirely on customer success. Her brand revolves around self-love and eco-friendliness.

Christina Orso – Saying ‘No’ is the better route in entrepreneurship

Christina Orso is a successful Boston-based entrepreneur who has succeeded thanks to her motivation and curiosity. Her marketing is focused on restaurants and food brands.

Leslie Polizzotto – From practicing law to running a doughnut shop

How do you go from practising law to running a world-famous doughnut shop in NYC? Leslie Polizzotto has the recipe for success.

Aja Blanco – There is no business success without customer success

Aja Blanco discovered early on her entrepreneurial journey that business success depends entirely on customer success. Her brand revolves around self-love and eco-friendliness.