Although time-consuming, poor credit may be repaired. It’s a minefield as well. You need to be aware of what to do, where to go for assistance, and which businesses to stay away from. The stakes are quite high, and the results can follow you for years.

Your credit history, report, and score all have a significant impact on your financial situation. They influence the particular parameters of the deal, such as how advantageous your interest rate will be, as well as whether you are authorized by lenders for items like a mortgage, personal loan, or auto loan.

Continue reading to find out more about the numerous tools, techniques, and behaviors that may help you raise a low credit score.

Self-reliance is possible

There’s nothing a reputable credit repair company can do for you that you couldn’t do yourself, so this might be an alternative, but if you pick the best company to repair credit, you won’t need to find out tons of information and do transactions where It’s easy to make a mistake and ruin everything. You may learn a lot about credit, how it works, and what you can do to fix your own by reading books and browsing the internet.

Techniques including challenging erroneous reports, debt validation, pay-for-delete services, and goodwill letters may be used to erase unfavorable information. All of these techniques are used by credit repair businesses to get inaccurate information taken out of your credit report.

You may save money by doing it yourself. Your credit history is likewise in your hands, under your control.

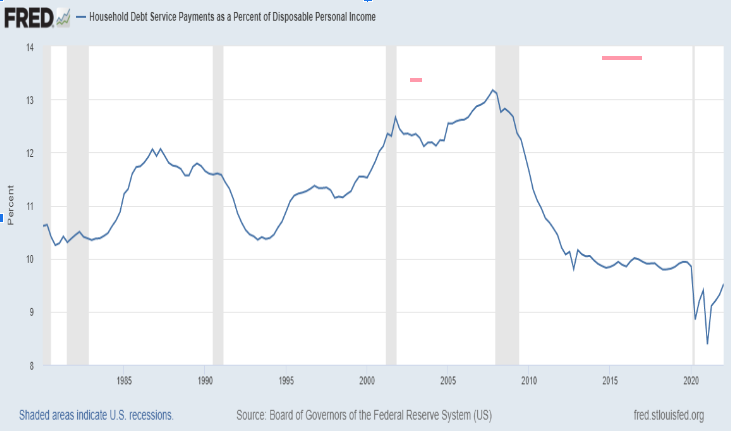

The Federal Reserve reports that in the first quarter of 2022, U.S. Household Debt Service Payments as a Percent of Disposable Personal Income is an average of 9.51904. This means that on average, households will spend 9.51904% of their disposable income on debt service payments, such as mortgage payments, credit card payments, and auto loan payments.

This is up from 9.48%, which was the average for the fourth quarter of 2021. However, it is down from the peak of 10.62% reached in the third quarter of 2007.

The report provides information on the percent of household income devoted to debt service payments, the median payment-to-income ratio, and the average payment-to-income ratio. The household debt service payments as a percent of disposable personal income helps to indicate the financial health of American consumers and is watched closely by economists.

A high DSP can indicate that consumers are struggling to keep up with their debt payments and may be at risk of defaulting on their loans. A low DSP can indicate that consumers are able to easily make their debt payments and are in good financial health.

It’s hard to remove accurate negative information

Here, the word “accurate” is highlighted. Only erroneous or unverifiable information may be

lawfully removed from your credit report by credit bureaus.

Since the credit bureaus have the legal power to disclose inaccurate negative information, doing so is more difficult. In reality, the accuracy of the information that credit bureaus report is essential to maintaining the integrity of the credit system.

However, there are several techniques that may assist you to get rid of true bad information,

such as a debt that you really owe that is in the collection. These tactics may need more

time and work than a straightforward credit report dispute, but they are still worth trying. The

greatest solutions for these kinds of accounts include requests for a goodwill deletion, paying

for deletion, and debt validation (for collection agencies).

Verify your credit report for any mistakes

To be sure there aren’t any false negatives, get a copy of your credit report. Common credit report inaccuracies, according to the Consumer Financial Protection Bureau, include canceled credit accounts displaying as open, loans that appear more than once, and erroneous amounts.

Visit annualcreditreport.com to get a free credit report from each of the three main credit agencies (Experian, Equifax, and TransUnion). Although you won’t get a score from this, it will highlight your shortcomings and potential development areas.

You may dispute any inaccurate information on your credit report by sending a letter to the relevant credit reporting organization if you find it. If you’re unclear about how to do this, the Federal Trade Commission offers a sample credit dispute letter that you may refer to.

Reconsider your approach to credit usage ratios

Your credit usage ratio calculates how much credit you are currently utilizing in comparison to your total credit limit. Never let this percentage exceed one-third or around 30% of your expenditure cap. If you have $1,000 in available credit, for instance, you shouldn’t utilize more than $300 of it.

Think about doing nothing

Negative items won’t remain on your credit record forever. Although there are a few exceptions, most reports are only kept there for seven years. For up to 10 years, a Chapter 7 bankruptcy, for instance, will remain on your credit record.

If you’re running out of time to delete the account from credit reporting, it can be less unpleasant and time-consuming to wait for it to naturally disappear. Contrary to common perception, responding to a negative account does not prolong the window for credit reporting. If you settle a six-year-old debt collection, it will still disappear off your record after the seventh year.

Obtain permission to use someone else’s credit card

A person added to an active credit card account under someone else’s name is known as an authorized user.

Authorized users are free to use the card as if it were their own, but they are not liable for any debt they accrue. Additionally, because they are sharing the card’s payment history and usage percentage, this might eventually raise their credit score.

Here, the cardholder bears the majority of the financial risk, not the authorized user. However, Lynch advises that if you’re seeking to establish credit, you should ask some “uncomfortable questions” before signing the contract, such as finding out the borrower’s payment history to see whether this is the best course of action for you.

Consider consolidating your debt

Bundling all of your loans into one is what debt consolidation entails. When compared to individual invoices, this often results in a cheaper interest rate or lower monthly payment.

Those who struggle to manage many due dates or have a variety of high-interest credit card balances would benefit from this repayment method.

Avoid undesirable behaviors

Without a comprehensive plan, avoid applying for several new credit cards or closing numerous accounts. Everything related to credit is interconnected, therefore deleting old accounts and starting new ones might damage your credit mix and history.

For instance, applying for multiple new credit cards quickly may lead to several hard inquiries, which might lower your credit score. Instead, think about obtaining a secured credit card or credit-builder loan.

Conclusion

Although repairing your credit might be a drawn-out process, it is ultimately worthwhile. You may either do this on your own or with the assistance of a credit repair business.

Whichever path you choose, maintaining good credit requires credit monitoring, timely monthly payments, and sound money management practices. The most crucial thing is to exercise patience and adhere to a successful approach.

More must-read stories from Enterprise League:

- Getting more customers – every business owner’s biggest concern.

- Why hiring Millennials is the best decision you can ever make.

- Damaging effects of micromanagement that business owners should know.

- 36 Bulletproof psychological tactics for successful marketing.

Related Articles

How do I reserve a space for a trade show in Pennsylvania

Trade shows are excellent business opportunities. Your upcoming event should occur in a space big enough to hold all participating brands while leaving room for visitors. Learning how to reserve a space for a trade show in Pennsylvania will help you find the best...

What Are the Best Event Venues for Corporate Meetings?

Finding the perfect event venue for your corporate meetings requires careful consideration of location, amenities, accessibility and reputation. The best venues provide excellent audio-visual capabilities, flexible meeting spaces, and professional decor options to...

Scaling Your Business with Blockchain: The Strategic Advantage of XRP

Explore how to scale business with blockchain technology, particularly using XRP for efficient international growth.

How do I reserve a space for a trade show in Pennsylvania

Trade shows are excellent business opportunities. Your upcoming event should occur in a space big enough to hold all participating brands while leaving room for visitors. Learning how to reserve a space for a trade show in Pennsylvania will help you find the best...

What Are the Best Event Venues for Corporate Meetings?

Finding the perfect event venue for your corporate meetings requires careful consideration of location, amenities, accessibility and reputation. The best venues provide excellent audio-visual capabilities, flexible meeting spaces, and professional decor options to...