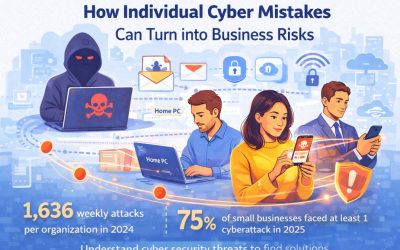

The data related to cyberattacks on businesses is simply eye-opening. In 2024, there were 1,636 weekly attacks per organization. In the case of small businesses, 75% of them experienced at least one cyberattack in 2025. A worrying trend that has come up is that...

Where can I buy inclusive commercial playground equipment?

The sun is shining, and a nearby family visits a local playground. They’ve been here before. The equipment allows their children to run off their extra energy while their special needs daughter laughs in the sensory swing. The business sponsoring the playground put a lot of thought into the needs of the local community and worked to ensure the area was inclusive for all abilities. Knowing where you can buy inclusive commercial playground equipment benefits every family and child in your community.

Inclusive playground equipment considers the needs of all children and strives to make different areas accessible. A setup might include ramps, accessible ground-level play areas, inclusive slides, safety nets, and sensory-friendly elements like adaptive swings and spinners.

Although inclusive playgrounds are nice for the surrounding community, they also offer multiple benefits to business owners. Investing in an inclusive commercial playground can bring attention to your brand and build goodwill with neighbors.

What is inclusive playground equipment?

Sensory-friendly playgrounds increase children’s sense of belonging by allowing them to participate in the same activities as their peers in the community. Since they engage through pretend play, offering spaces for kids with disabilities provides crucial resources for parents, teachers, and therapists to offer independent playtime.

Consider this equipment for an inclusive playground:

- Ramps and transfer stations for children in wheelchairs

- Textured surfaces and musical instruments to cater to kids with sensory processing disorders

- Seatbelts or bars on swings and merry-go-rounds to strap children in and help with muscle control and stability

- Wider slides to accommodate a child and their caregiver

- Wheelchair-accessible swings so kids with mobility issues can get in and out on their own and enjoy time with their peers

- Nest swings for multiple children to play together and encourage inclusiveness

- Ground-level activity panels to incorporate the senses and allow children to easily access them without climbing

Although an inclusive playground design ensures children with special needs can access equipment, kids of all abilities can easily play together. Ramps make it easier for all children to climb, and younger ones can strap into a spinner and enjoy the fun alongside their older counterparts. Modern playground design considers all children, with or without disabilities, and makes the outing to a local play area fun and engaging.

Where can I buy inclusive commercial playground equipment?

Buying the right equipment to meet the needs of all children in the neighboring community is complex. Fortunately, reputable suppliers and manufacturers of inclusive playground equipment offer consultations and can help you decide which pieces to buy. Many install the items for you to ensure they are safely secured and the layout is intuitive.

Here are the top companies that have commercial playground equipment for sale.

Little Tikes commercial

Little Tikes Commercial and Unlimited Play have two levels of inclusive play spaces. The Platinum level is fully inclusive, and the Gold level adds some inclusive features for those with smaller spaces or tighter budgets.

The brand embraces public playground safety standards like the ASTM International certification, Consumer Product Safety Commission guidelines and Canadian Standard Association. It also creates playgrounds to help businesses meet Americans With Disabilities Act (ADA) compliance.

Numerous business owners share their experience with the brand on the Little Tikes Commercial website. They point out the interactive play areas, with safety and inclusiveness at the center of each design. Little Tikes partners with charities, including Kids Around the World and Alex’s Lemonade Stand Foundation. It participates in charitable giving via other partnerships.

The equipment the company offers includes sensory panels, accessible swings, ramps, and safety nets and harnesses.

Noah’s park and playgrounds

An in-house computer-assisted design team can work with your business to ensure you select the correct inclusive playground equipment to meet space needs and community desires. The organization also offers installation for peace of mind that the area is safe for local children.

Products are IPEMA-tested and meet the standards of ASTM and CPSC. Customers consistently rate the company five out of five stars on its website, sharing appreciation for the custom work, how kind the team is and how much they love their new playgrounds.

No charity partnerships were listed on the company’s website. However, it keeps a running list of potential grants customers can secure if they’re working on a tight budget.

The company sells everything from springer toys to complete inclusive playground design. It also specializes in eco-friendly options.

Pro playgrounds

Pro Playgrounds has serviced the recreation industry for 15 years. Its mission statement is to create play areas for kids of all disabilities, races and socioeconomic means. It offers both indoor and outdoor playgrounds alongside shade structures.

The staff is made up of licensed general contractors and NPSI-certified playground safety inspectors. The company has over 1,000 projects under its belt, making it well-experienced in playground creation and installation.

The brand has five out of five stars on Google Reviews. Customers say installation was excellent, the company was professional and it handled challenges well.

Pro Playgrounds also offers a number of grant options, but it partners with organizations to ensure businesses and institutions can install ADA enhancements. It will guide customers through the application process. It sells commercial inclusive playground equipment and playground floors.

Which businesses benefit the most from investing in inclusive playgrounds?

Installing a sensory-first, handicap-accessible play area at your company improves your brand image. It shows you have a commitment to inclusivity, and parents of children with disabilities will be more likely to do business with you and remain loyal. Offering an inclusive playground can attract new customers by giving you a unique selling point.

Playgrounds combat sedentary lifestyles and improve the physical and mental well-being of children in the neighborhood. Parents who bring kids to the area also bring more foot traffic, which increases your business’s name recognition and keeps you at the front of people’s minds.

Some business types benefit more than others. Ones particularly well suited for inclusive playgrounds include:

- Schools and day care centers

- Family-friendly hotels and resorts

- Religious organizations

- Apartment complexes and close-knit neighborhoods

- Parks

- Restaurants and retail establishments

Adding an inclusive playground welcomes families from all walks of life. You’ll create a warm, welcoming atmosphere for the local community and build a sense of belonging and connection.

Factors to consider when choosing inclusive playground equipment

The ADA lists places subject to its regulations in 12 different categories, including those that are open to the public, such as restaurants, schools, theaters and other commercial facilities. When companies ensure the equipment meets the needs of children of all abilities, it will be easier to comply with ADA requirements.

Companies should make sure their insurance is up to date and they prioritize safety features. Choose items that hold up to extreme weather and ongoing use. While the cost of installing accessible playground equipment can be prohibitive, businesses should get the best pieces possible within their means.

Government grants at the federal, state and local levels can help with some of the expenses. Companies can also reach out to private foundations, ask for other corporations to partner on the project or host fundraisers.

Conclusion

Inclusive playgrounds bring numerous benefits to businesses and communities. Creating a sense of belonging among neighbors while bringing more foot traffic to your vicinity offers advantages to local citizens and the company. You can buy inclusive commercial playground equipment, but knowing what you want to achieve and how to pay for it may be the key ingredients you’ve been missing.

Take the first step today by getting a quote for the playground of your dreams. With a little work and fundraising, you’ll have a thriving area local families can utilize for mental health and physical well-being.

More must-read stories from Enterprise League:

- Engaging online networking events that you should not miss.

- What’s the secret to running successful cold email campaigns?

- Foretelling: transform your business by predicting future trends.

- Engaging online networking events that you should not miss.

- Warning signs of a terrible boss that everyone must be aware of.

Related Articles

How Individual Cyber Mistakes Can Turn into Business Risks

Your Online Reputation Is Not One Site, It Is the Whole Trail

Learn how to connect your social profiles, old bios, news mentions, and reviews into one clear story so people trust your business faster. Most founders think their reputation lives in one place, like a Google Business Profile, a LinkedIn page, or a single article. In...

What Are the Best-Value Cleaning Solutions for High-Volume Car Washes? 7 Options for Managers

Cleaning products are vital to a car wash's efficiency, profitability and customer satisfaction. Therefore, industry professionals must be selective and identify the best brands for their operations. While spotless finishes are essential, the cleaners should also...

What Are the Best Value Cleaning Solutions for High-Volume Car Washes? 5 Options for Managers

For high-volume car wash businesses, the right chemical supplier is the backbone of their operations. Today's competitive marketplace demands bulk solutions that are effective, reliable and tailored for maximum throughput. Whether you operate automated tunnels, in-bay...

What’s the Best Parcel Auditing Company? Here Are the 5 Top Options

With shipping costs on the rise and carrier invoices growing increasingly complex, businesses face significant challenges in managing their logistics expenses. Rising costs can often lead to inefficiencies and lost savings. Working with a parcel auditing company is a...