Dump trailers are a worthwhile investment for many service-oriented businesses. In Pennsylvania, where real estate markets are hot, home improvement activity is high and the agriculture industry is strong, building your fleet to clear out construction sites, houses,...

Building a successful B2B business model in 2025

Most people think selling is just selling, no matter who the customer is. But ask anyone who’s jumped from retail to B2B, and they’ll tell you it’s a whole new ball game. Building a B2B brand requires completely different strategies than consumer marketing, with an emphasis on expertise, reliability, and measurable business outcomes.

B2B business models work nothing like the consumer world, they depend on longer-term thinking, complex buyer groups, and solutions that solve real business problems. With a market size predicted to reach USD 174.38 trillion by 2030, it’s no wonder companies are rushing to perfect their business-to-business approach.

How B2B works

B2B doesn’t just mean slapping a wholesale price on your regular products and calling it a day. It’s about creating systems where businesses can buy from you in ways that make sense for them. Most B2B transactions happen through dedicated sales teams, not shopping carts, though online B2B marketplaces are growing fast.

The buying process typically involves multiple decision-makers, technical experts, end users, finance people, and executives all weighing in before a purchase happens. That’s why B2B sales cycles often take months, not minutes. Companies need to show clear ROI, compatibility with existing systems, and long-term support options. Creating a compelling B2B business proposal that addresses all these concerns becomes crucial for closing deals. Pricing usually involves custom quotes rather than fixed rates, with volume discounts, annual contracts, and service-level agreements being common.

Core principles of B2B business model

Behind every successful B2B company stands a solid set of principles that guide how they operate. First off, customer relationships matter more than anything else – these aren’t one-and-done transactions but ongoing partnerships that might last decades. Value creation needs to be measurable in dollars and cents, not just feel-good marketing speak. B2B models also rely heavily on specialization, knowing your niche inside and out, and becoming the go-to expert in that specific area.

Successful B2B businesses understand the entire ecosystem in which their clients operate, not just their immediate needs. They also build scalable systems that can handle both small businesses needing basic services and enterprise clients requiring custom solutions. Smart B2B marketing tips focus on demonstrating expertise through content that educates prospects rather than interrupting them with advertisements. Perhaps most importantly, B2B companies need patience, they’re playing the long game, investing in relationships that might not pay off for months but eventually become their most profitable accounts.

Building the right B2B product

The difference between a B2B product that succeeds in the market and one that fails often comes down to how thoroughly you understand the daily reality of your target customers. Effective B2B products don’t pursue innovative technology for its own sake – they address specific workflow problems that frustrate professionals regularly. This requires leaving your office environment and directly observing potential users, documenting their challenges and makeshift solutions. Many B2B startups fail precisely because they skip this critical research phase, building solutions for problems that don’t actually exist. Successful B2B products typically address:

- Handling large volumes of data or transactions that would overwhelm consumer solutions

- Meeting industry-specific regulatory requirements and compliance standards

- Enabling collaborative workflows across departments and organizational structures

- Processing complex information in ways that yield actionable business insights

- Integrating seamlessly with existing technology systems and infrastructure

They must also account for organizational needs beyond individual users – providing administrator controls, usage statistics, and security that meets enterprise standards. Companies that excel at B2B product development view customer support interactions as valuable sources of insight, not unwelcome distractions. They recognize that businesses purchase results, not features, so each product decision relates directly to measurable business benefits their customers can present to their leadership teams.

B2B business model vs. Traditional models

When we compare B2B models with traditional consumer businesses, the differences go far beyond just who buys the product. B2B companies operate with entirely different metrics, sales approaches, and relationship dynamics. While consumer brands chase website traffic and social media engagement, B2B firms track metrics like customer lifetime value, contract renewal rates, and solution adoption. Effective B2B lead generation strategies focus on quality over quantity, targeting specific decision-makers rather than casting wide nets. The key differences include:

- Sales complexity: B2B deals might take 6-12 months and involve multiple decision-makers, whereas consumer purchases happen in minutes or days

- Price points: B2B solutions typically cost thousands or even millions, not tens or hundreds of dollars

- Marketing focus: B2B marketing centers on education and problem-solving content rather than emotional appeals

- Customer numbers: B2B companies might thrive with hundreds of clients, while consumer businesses need thousands or millions

- Support expectations: B2B clients expect personalized service and dedicated account managers, not chatbots or email tickets

Most importantly, B2B relationships continue well past the initial sale. B2B customers become genuine partners who provide ongoing feedback, shape future product development, and stick with vendors for years when treated properly. Companies looking to increase B2B sales often find that growing existing accounts through expanded services yields better results than constantly chasing new logos. This long-term focus changes everything from cash flow projections to how companies structure their support and success teams.

Conclusion

The B2B business model continues to offer tremendous opportunities for companies willing to invest in understanding complex business needs and while consumer markets might reward viral growth and emotional appeal, B2B rewards expertise, reliability, and results.

More must-read stories from Enterprise League:

- Motivating business role models to inspire your entrepreneurial spirit.

- Foretelling: transform your business by predicting future trends.

- Engaging online networking events that you should not miss.

- Innovative small business growth tips that will take you to the next level.

- Learn about how micromanaging can hurt your productivity.

Related Articles

What’s the Best Place to Buy a Dump Trailer in PA?

What’s the Best Ceramic Car Wash Soap? 5 Top Options

Hydrophobic automotive coatings have moved from a premium upsell to an expectation. Customers seek deep gloss, instant water beading and long-term protection, requiring car wash operators to use chemistry that supports rather than harms protective finishes....

What are the best fire hydrant suppliers? Here are 5 options for Louisiana municipalities

Fire hydrants are among the most visible, yet often underappreciated, elements of municipal infrastructure. In emergencies, properly functioning hydrants directly impact how effectively firefighters can control blazes, protecting lives, homes, businesses and public...

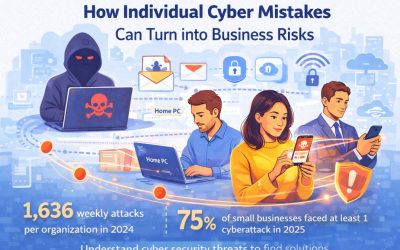

How Individual Cyber Mistakes Can Turn into Business Risks

The data related to cyberattacks on businesses is simply eye-opening. In 2024, there were 1,636 weekly attacks per organization. In the case of small businesses, 75% of them experienced at least one cyberattack in 2025. A worrying trend that has come up is that...

Your Online Reputation Is Not One Site, It Is the Whole Trail

Learn how to connect your social profiles, old bios, news mentions, and reviews into one clear story so people trust your business faster. Most founders think their reputation lives in one place, like a Google Business Profile, a LinkedIn page, or a single article. In...