Easiest way to Avail Govt Loans up to NABARD subsidy to start your own dairy farm

August 17, 2022

Agriculture is the biggest economic sector in India. Not only does the sector contribute a huge amount to the country’s GDP, but it also offers the maximum employment to the country’s population. It is now easier than ever to avail loans of up to Rs. 20 lakh to set up agricultural operations, and especially dairy farms, through NABARD schemes and subsidies.

Features of NABARD subsidy for dairy farm loan

- NABARD is responsible for curating and redefining policies of financial institutions of rural India

- NABARD subsidy aims to offer fund assistance to the natives of rural India for the infrastructural growth and development of their businesses.

- NABARD also offers the facility of long-term and short-term refinance to people.

- Any marketing federation operating in rural India can also request a credit facility under the NABARD scheme

Benefits of dairy farm loan

Availing a business loan for dairy farm is an easy and quick process that can be completed from your phone too. With the aid of NABARD’s subsidy, business loans are now comparatively cheaper to avail too. Read on below to learn the features and benefits of availing a dairy farm loan

- No collateral – You are not required to offer any collateral to the lender for availing a loan. This makes availing a loan much less stressful.

- Flexible Repayment – The loan can be repaid within 12 to 60 months, ensuring a flexible repayment schedule for you to stick to.

- High Loan Limit – Your dairy farm will need massive funding while beginning operations.You can avail up to Rs. 30 lakh and invest it towards your business in the best possible manner.

- Instant Approval – The Non-banking financial institutions (NBFCs) instantly approve the business loan applications, as there is no collateral or guarantee is involved. Therefore, the processing time taken for verification and authentication of the loan application is reduced and loans are approved within 24 hours.

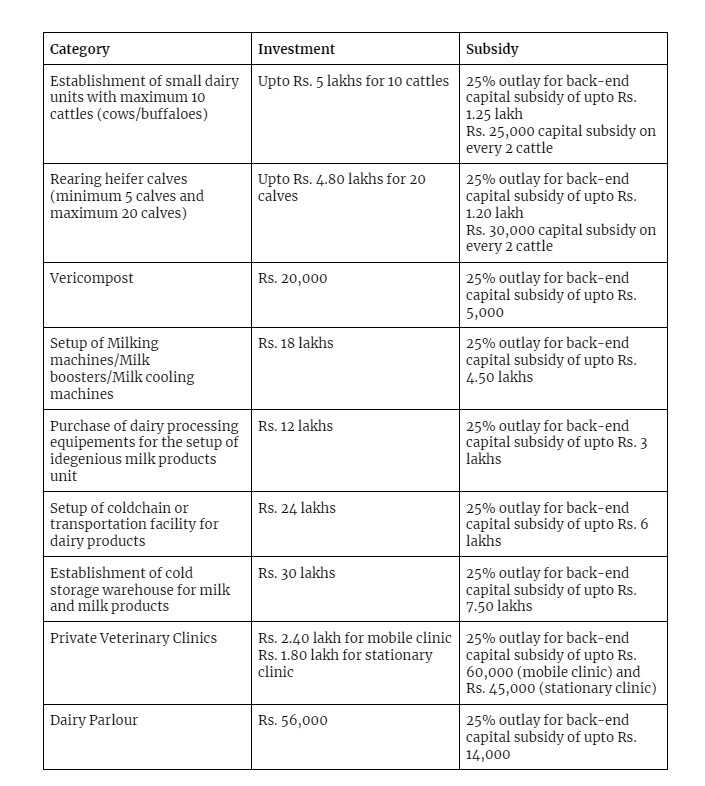

Types of NABARD Dairy Farming Subsidy Schemes

Interest rate offered by NABARD scheme on refinance to banks

Check out the table below to find out the interest rates offered by NABARD scheme on refinance to banks and NBFCs for the year 2022:

|

Short-Term Refinance Assistance |

Starting at 4.50% |

|

Long-Term Refinance Assistance |

Starting at 8.50% |

|

Regional Rural Banks (RRBs) |

Starting at 8.35% |

|

State Cooperative Banks (StCBs) |

Starting at 8.35% |

|

State Cooperative Agriculture and Rural Development Banks (SCARDBs) |

Starting at 8.35% |

Eligibility for dairy farm loan

NABARD schemes on dairy farm loans are applicable for individual entrepreneurs, farmers, companies, NGOs, groups from the unorganised sector, and groups from the organised sector, such as self help groups, milk unions, dairy cooperative societies, milk federations, etc.

Regardless of the applicant’s status, there are some eligibility criterion that they are required to meet in order to avail a business loan for dairy farm. Read on below to understand the eligibility criteria.

- The applicant must be aged between 26 to 70 years.

- The business should have been operational for at least three years.

- The applicant will be required to submit their income tax returns from at least a year back.

- The applicant needs to be self-employed in order to avail this business loan for dairy farm.

Documents required for dairy farm loan

To avail a business loan for dairy farm, there are several documents you are required to submit. Read on below to learn more.

- Proof of identification, such as Aadhaar card, voter ID, PAN card, etc.

- Proof of residence, such as Aadhaar card, passport, voter ID, etc.

- Other documents relating to your business, as per your application.

How to avail subsidy under NABARD scheme

Once you have availed the business loan, it is important to apply for the subsidy available under NABARD schemes. Read on below to understand how you can do this easily and quickly.

- Once the first loan installment has been disbursed, your lender must apply to NABARD for approval and release of the subsidy.

- As per the provisions of NABARD schemes, the subsidy would be deposited in a “Subsidy Reserve” account.

- The subsidy amount would then get adjusted against the last few repayments of the business loan for dairy farm that you have availed.

More must-read stories from Enterprise League:

- The golden rules you need to build a steady buyer-seller relationship.

- 36 psychological marketing tactics, successful marketers use.

- Get entertained and educated with these 20 best business movies.

- What is a wholesale business and 15 tips for beginners.

- Having problems retaining customers? Try one of these 13 customer retention strategies now.

Related Articles

Scaling your data annotation efforts: A guide to efficient labeling

This guide highlights the critical role of a thought-out data labeling strategy, digs into workflow optimization and presents actionable steps for scaling up.

Top 26 sheet metal companies paving the way forward (2024)

The top 26 sheet metal companies with the smartest techniques of sheet metal fabrication. Find out what technologies they use and how are they shaping the path forward.

8 essential skills you need to run a successful business

We will go through the eight critical skills that entrepreneurs and business leaders need to master to establish flourishing and enduring businesses.

Scaling your data annotation efforts: A guide to efficient labeling

This guide highlights the critical role of a thought-out data labeling strategy, digs into workflow optimization and presents actionable steps for scaling up.

Top 26 sheet metal companies paving the way forward (2024)

The top 26 sheet metal companies with the smartest techniques of sheet metal fabrication. Find out what technologies they use and how are they shaping the path forward.