Shopping is an exciting activity, but for big and tall men, it can be a source of frustration. With most mainstream clothing brands still prioritizing standard sizing, it can be difficult to find garments that are both stylish and well-fitting. Fortunately, there are...

Benefits of crypto and the problems it solves in the business world

Benefits of crypto and the problems it solves in the business world

March 27, 2024

Crypto technology has only been around for some 12+ years. However, the impact it created is pervasive. Not only is it revolutionizing modern-day industries but challenging our approach to work every day. Bringing in transparency, speed, and performance, cryptocurrency is driving us to the future of global industries.

But to understand the benefits of crypto and how can help you grow your business requires understanding the multi-level benefits it brings to your operations. This is what exactly we are going to reveal in this post.

We take a deep dive into the core areas where this bleeding-edge technology leverages your business to improve your sales pipeline and create a more robust and sustainable business.

Let’s dive in.

9 benefits of the crypto revolution for your business in 2024

Cryptocurrency brings a multitude of benefits to businesses and their consumers alike. But at the core, it revolutionizes how we look at business operations today. This makes understanding the benefits of crypto easier if we map how it solves the core problem areas that matter for a business.

The following are the most prominent ones that you can readily witness in your business.

1. Transparent and faster transactions

Unlike traditional businesses, crypto does not complicate the transaction process between two parties.

Decluttering the transaction landscape from brokers, agents, legal representatives, and other middlemen, the crypto technology creates a safe and secure one-on-one direct transaction landscape. Integrating a peer-to-peer networking infrastructure, you can directly conduct a transaction with the responsible party. It is advisable to use a professional firm such as this UK crypto accountant to make sure you keep on top of your financial gains.

What follows is a discernable reduction in unnecessary expense and time consumption required to complete one successful transaction between two parties. What’s more? You get more transparent and simpler audit trails bringing in greater accountability in every activity. This means better optimization of your business resources.

2. Easy asset transfer

One of the most innovative benefits of investing in cryptocurrency for business across all verticals is a safe and hassle-free asset transferring system. Here’s how it works?

The cryptocurrency blockchain is like a gigantic database of property rights that can be leveraged to execute and enforce two-party contracts on multifarious commodities of which automobiles and real estate are the most common. However, cryptocurrency does not stop at that. It can also facilitate other modes of transfer that require special modifications , such as the Bybit card for seamless transactions.

Speaking of how to use cryptocurrency for business, you can design a contract to add a third party approval, refer to external facts, or timestamp your contracts with precision. What’s more? Because cryptocurrency enforces advanced security over the access of respective accounts, your exclusive governance makes asset transfer time and expense radically go down.

3. Improved confidentiality

Unlike traditional banking systems, cryptocurrency brings more flexibility regarding what information you want to share with your banking agents every time you do a transaction.

In a banking system, whenever you use debit or credit cards to perform a transaction, it gets documented via a reference number to keep records of how money flows in and out. For even more complex business transactions, a thorough financial audit might be required. But with cryptocurrency, you can filter the information at each step of the transaction.

Each transaction you make through cryptocurrency is unique, that you can regulate between two parties. From negotiations to agreements, all can be filtered out at every step. What’s more? The exchange of information is performed via a push approach that gives you leverage to transfer exactly what you like and how you like.

As a result, your financial history trail and privacy get better protection from identity threats and hackers throughout the transaction chain, an element in which a traditional banking system fails to serve your business.

4. Lower transaction fees

No doubt you are well versed with your monthly statements from the bank, whether you are writing a check, using your credit and debit cards, or using electronic transfer facilities like mobile banking and internet banking. But what looks very insignificant of an amount for single processing can take the shape of significance when accumulated together. This becomes even more significant if your business integrates high-frequency daily transactions.

If you take a close look at your business account, you might get surprised to see the amount of money that you pay as transaction fees in a month.

Cryptocurrencies like Bitcoin and USDC successfully removes this barrier so that you can focus on fast and easy transactions. To reduce the transaction fees, cryptocurrency uses a data mining model.

Here the coders and developers, also known as data miners, perform the data crunching using multiple computers and systems interconnected through the same network located at various places globally. As these developers receive their compensation through the crypto network, the transactions fee goes significantly down. There are times when it is not even applied.

5. Higher accessibility

One of the unfair business uses for cryptocurrency is higher levels of accessibility to transact. No matter what place you are located in, the remote and rural or accessible, metropolitan city, you can perform transactions from the comfort of your home.

Cryptocurrency transfers operate on two foundational elements: the internet and safe virtual data transfer. This makes this facility readily available to one and all. All you need is a viable internet connection, preferably a high-speed one, and some knowledge about the cryptocurrency platforms facilitating the transfer.

This viability creates opportunities for businesses to develop their customized network of partners and vendors, allowing you to optimize your product development costs.

A recent study estimates that almost 2.2 billion individuals have internet access yet no traditional banking access. This is a heavy indication of the opportunity available for businesses to grow their networks with audiences where it was not possible in the past.

6. Easier international trade

The benefits of using international money transfer companies are many. They are easier to use, cheaper, and faster But it’s important to understand that not all businesses in this relatively new industry are equally reliable. Therefore, you should use a comprehensive international money transfer service guide to choose the company you can trust with your money.It is worth to note that. unlike traditional international money transfer services, cryptocurrency doesn’t bar international trades.

This means no matter where you are placed and with whom you perform a business transaction, traditionally imposed taxes and restrictions like exchange rates, interest rates, transaction fees, and other levied charges by specific countries are not applicable in this transaction ecosystem.

What follows is a free flow of international trade and exchange. To facilitate this, cryptocurrency integrates the decentralized, peer-to-peer model of blockchain technology, creating simpler, faster, and more transparent trading. What’s more? You do not need to overthink the highly volatile nature of currency exchange rates here.

7. Maximum control

One of the most considerable assurances that cryptocurrency provides is complete ownership of your assets and accounts, unlike traditional models of banking.

In a traditional banking system where a third party safeguards your funds with distributed ownership, your assets are always in a high-risk zone. Your account can get closed without prior notice due to multiple reasons like infringement of terms and conditions and more. This not only creates complexities and chaos but dampens your asset security.

Cryptocurrency gives you complete authority and ownership of your crypto wallet encryption keys without any intervention from 3rd parties. Neither can anyone else access nor operate your crypto wallet until you delegate the management and maintenance task to a service provider.

9. Robust security

If there is one element that the cryptocurrency champions, it is complete security for all the parties involved in a transaction.

Starting a cryptocurrency transfer requires you to authorize the transaction via all the stakeholders involved. Once done so, it cannot undergo a reversal process like traditional banking facilities.

This step is designed to validate the authenticity of the stakeholders and is a significant step to fight back against frauds and scams over the landscape. Creating a specific agreement established a hedge between the buyer and seller refunds for the specific event if any failure to meet any expectation was defined and agreed upon in the agreement.

Cryptocurrency utilizes a decentralized and powerful encryption technology to process and store transaction data and ledgers to ensure the security of accounts and transactions performed over its network.

Conclusion

Cryptocurrency is no doubt the technology of the future. Benefits of crypto have the potential to transform your complete business ecosystem by exponents, be its transparency, speed, or costs.

However, here’s what you need to be aware of.

This technology is still in its early developmental stage, with new virtual currencies being launched each day. The same reason makes its adoption rate still much low. This means you have a first-mover advantage here. The faster you integrate it into your business operations, the higher your chances to possess advantages over your competitors.

This leaves only one question left unanswered. When are you integrating cryptocurrency into your business?

More must-read stories from Enterprise League:

- Supply chain management: Issues and solutions in today’s world.

- Foretelling: transform your business by predicting future trends.

- Mindblowing guerrilla marketing ideas.

- Do you have a hobby? Do you want to turn it into a business? Here is how.

- Everything you need to know about enterprise cybersecurity if you are working remotely.

Related Articles

What Are the Top-Rated Big & Tall Clothing Stores? These Are the 9 Best Options

The best luxury gifts for Christmas

Christmas shopping for luxury gifts can feel overwhelming, especially when you want to give something truly memorable. After years of searching for the perfect presents, testing different categories, and learning from both successes and disappointments, I've...

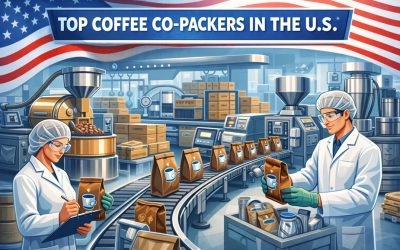

What Are the Most Reliable Co-Packing Services for Coffee in the U.S.? Here Are the 8 Top Options

Finding the right co-packing partner is essential for coffee brands aiming to scale, maintain quality and deliver consistent products. Co-packers provide the expertise, equipment and processes that let brands focus on crafting exceptional coffee while handling...

4 Top-Rated Fleet Management Services for Mobile Health Care Providers

As the number of mobile health care programs rises, their success depends on medical expertise and flawless logistics. Challenges like vehicle uptime, specialized maintenance, driver staffing, regulatory compliance and route optimization can overwhelm organizations....

Why Every Business Needs a Technical SEO Agency

Introduction Just having a website isn't enough for businesses today. Companies, especially SaaS businesses, need to make sure their platforms are visible and user-friendly. This is where SEO for SaaS comes in. But SEO isn't just about adding keywords; it requires a...